👋 Bhupendra Rawat

Stock Market Data Analyst | Programming Enthusiast | 4+ Years of Experience

Empowering insights with data & code🔍 Expertise:

- Fundamental & Technical Analysis

- Python & Pandas for Stock Data

- Interactive Financial Dashboards

- JavaScript & Chart.js Visualization

🔄 Last Updated: Analysis Based on Data Till 2 August 2025

🏗️ NBCC Share Price Target 2025–2026: A Smart Pick for Infrastructure Growth?

NBCC (India) Ltd, a Navratna PSU under the Ministry of Housing and Urban Affairs, plays a pivotal role in construction, real estate, and project management consultancy, especially for government-backed redevelopment projects.

The share price trajectory of NBCC by 2025–26 is expected to be influenced by:

Continued push for urban renewal and smart city projects

Execution of large-scale government redevelopment contracts

Expansion in international markets and EPC projects

Stable financials and improving profit margins

Analyst upgrades and improving order inflow

With a growing order book and strong backing from government initiatives like the Central Vista and smart city missions, NBCC holds long-term promise. However, the company’s execution speed and timely revenue realization will remain crucial factors.

Despite market volatility, NBCC’s strategic role in nation-building could make it a steady long-term play in India’s infrastructure story.

✅ 2026 Target View – NBCC:

If project delays, slow government approvals, or rising costs pressure margins, NBCC’s stock may fall to ₹90.

However, if smart city initiatives, government redevelopment plans, and infrastructure contracts progress smoothly, the stock could reach ₹140.

📉 Downside Risk: ₹90 (approx. -17%)

📈 Upside Potential: ₹140+

🔎 Note:

Stock price targets are indicative, not guaranteed. Analysts consider company fundamentals, order book, technical trends, and overall market sentiment while giving such projections.

📊 For Short-Term / Intraday Traders:

If you want daily trading levels, live analysis, and intraday strategies for NBCC and other stocks —

join our free Telegram group, where you get professional-level market insights and trading guidance every day.

🔄 Last Updated: Analysis Based on Data Till 1 August 2025

📊 NBCC Financial Overview (2021–2025)

📊 NBCC Fundamental Analysis: Evaluating the Core Strength of the Company

This section dives into revenue growth, net profit, EPS, ROE, debt-to-equity, and other key financial metrics to understand long-term stability.

🔸 Revenue & Growth

The company’s revenue has shown consistent growth over the past five years, rising from ₹6,832 Cr in 2021 to ₹12,039 Cr in 2025. The growth was especially strong in 2024, reflecting improved execution and project scale-up.

➡️ 2021: ₹6,832.07 Cr

➡️ 2022: ₹7,690.61 Cr (+12.57%)

➡️ 2023: ₹8,754.44 Cr (+13.83%)

➡️ 2024: ₹10,432.64 Cr (+19.17%)

➡️ 2025: ₹12,038.57 Cr (+15.39%)

📈 The company maintained a robust double-digit growth trajectory, indicating strong operational momentum and increasing order execution capacity.

🔸 Net Profit & Margins

Net profit has also seen steady improvement, with margins gradually rising — a sign of better cost control and efficiency gains over time.

➡️ 2021: ₹236.44 Cr (Margin: 3.46%)

➡️ 2022: ₹237.90 Cr (3.09%)

➡️ 2023: ₹277.02 Cr (3.16%)

➡️ 2024: ₹414.27 Cr (3.97%)

➡️ 2025: ₹557.47 Cr (4.63%)

💡 Margins are improving year after year, signaling a positive trend in profitability and value creation.

🔸 EPS & Growth

Earnings Per Share (EPS) remained flat from 2021 to 2023 but doubled in 2024 — suggesting a breakout year — and remained stable in 2025.

➡️ 2021: ₹1

➡️ 2022: ₹1 (0.0%)

➡️ 2023: ₹1 (0.0%)

➡️ 2024: ₹2 (+100%)

➡️ 2025: ₹2 (0.0%)

📊 EPS jump in 2024 reflects strong profit expansion. Stability in 2025 suggests consolidation after a breakout year.

🔸 Return on Equity (ROE)

ROE has improved steadily over the years, indicating efficient use of shareholder capital. The rise in FY25 especially highlights strong financial performance.

➡️ FY22: 13.97%

➡️ FY23: 14.92%

➡️ FY24: 19.87%

➡️ FY25: 23.7%

📈 Rising ROE is a strong indicator of value generation and attractive returns on equity investment.

🔸 Debt-to-Equity Ratio

The company’s leverage position has improved significantly, with the debt-to-equity ratio falling steadily — a very healthy sign for balance sheet strength.

➡️ FY21: 6.94

➡️ FY22: 6.51

➡️ FY23: 5.53

➡️ FY24: 4.66

➡️ FY25: 4.42

📉 The steady decline in debt-to-equity ratio indicates better financial discipline and lower risk.

📌 Conclusion

This company demonstrates strong fundamentals across key metrics — revenue, profit, EPS, and return ratios — with improving margins and a stronger balance sheet. FY24 and FY25 show impressive acceleration in profits and returns, making it a potential long-term investment candidate.

✅ Why it stands out:

Consistent revenue growth

Rising net margins and EPS

Strong ROE

Improving debt profile

If infrastructure growth continues in India, this company could sustain its upward trajectory through 2026 and beyond.

📈NBCC Technical Analysis: Price Charts, Trends & Potential Movements

Here, we analyze price action, support/resistance levels, moving averages, RSI, MACD, and other indicators to forecast near- and long-term movements.

📈 NBCC Share Performance Snapshot (2025)

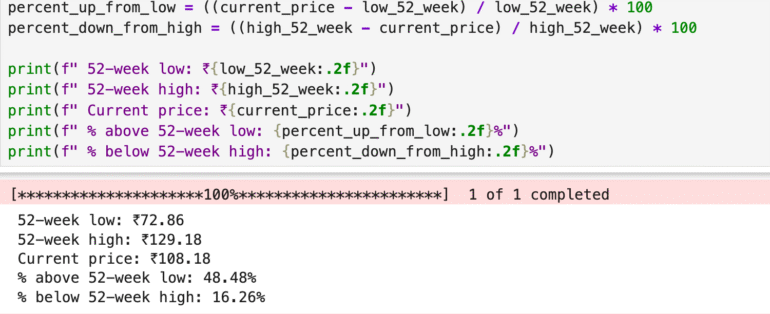

🔻 52-week Low: ₹72.86

🔺 52-week High: ₹129.18

📊 Current Price: ₹108.18

➡️ Above 52-week Low by: +48.48%

⬅️ Below 52-week High by: -16.26%

📌 This data shows that NBCC has recovered significantly from its 52-week low, gaining nearly 48%. Although it’s still 16% below its peak, the strong recovery suggests bullish sentiment. If order inflows and project execution continue improving, there could be further upside potential.

📉 NBCC Technical Overview (2025)

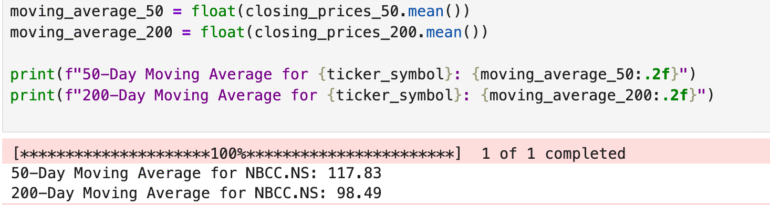

📊 Current Price: ₹108.18

📈 50-Day Moving Average (DMA): ₹117.83

📉 200-Day Moving Average (DMA): ₹98.49

🔍 Analysis:

The current price is below the 50-DMA (₹117.83), indicating short-term weakness or possible consolidation.

However, it is above the 200-DMA (₹98.49), which reflects a bullish long-term trend.

📌 Conclusion: While NBCC may be facing short-term resistance, its position above the 200-day average suggests continued investor confidence in the long-term. A breakout above the 50-DMA could signal renewed upward momentum.

🔍 Competitor Analysis: How NBCC Stacks Up

NBCC (India) Ltd., a government-owned Navratna enterprise, is known for its strength in project management consultancy (PMC), real estate redevelopment, and EPC works. With consistent government contracts, NBCC maintains a strong foothold in the construction and urban renewal space. Here’s how it compares with peers:

L&T Share Price Target 2025–2026 – India’s most diversified and large-scale infrastructure company with operations across heavy civil, defence, hydrocarbon, and global projects. Known for stable growth and strong balance sheet.

RVNL Share Price Target 2025–2026 – A specialized railway infrastructure PSU delivering consistent performance, backed by government contracts and a low-risk execution model.

✅ Comparing these players helps investors evaluate NBCC’s unique positioning in urban redevelopment and project management, particularly in government-led initiatives like CPWD and Smart Cities. It also highlights its low-capex model, strong PSU support, and moderate but steady growth potential compared to more diversified or sector-specific peers.