👋 Bhupendra Rawat

Stock Market Data Analyst | Programming Enthusiast | 4+ Years of Experience

Empowering insights with data & code🔍 Expertise:

- Fundamental & Technical Analysis

- Python & Pandas for Stock Data

- Interactive Financial Dashboards

- JavaScript & Chart.js Visualization

🔄 Last Updated: Analysis Based on Data Till 6 August 2025

⚡ CONCOR Share Price Target 2025–2026: Riding India’s Logistics Growth and Infrastructure Boom?

Container Corporation of India (CONCOR), India’s leading multimodal logistics and container freight operator, is strategically positioned to benefit from the country’s rapid infrastructure development and rising trade volumes. As India pushes for logistics efficiency, rail freight expansion, and dedicated freight corridors (DFCs), CONCOR stands to gain significantly in the coming years.

The share price outlook for CONCOR by 2025–26 will likely be influenced by:

Commissioning and expansion of Dedicated Freight Corridors (DFCs)

Rising EXIM trade and domestic containerization

Government focus on reducing logistics costs and improving multimodal connectivity

Stable financial performance with strong cash flows and minimal debt

Asset-light expansion plans and improved terminal efficiency

As India aims to become a $5 trillion economy with modernized logistics infrastructure, CONCOR’s established network and operational scale offer a strong competitive edge. While near-term market volatility and regulatory uncertainty exist, long-term growth visibility remains intact.

For investors seeking a stable, infrastructure-driven play, CONCOR offers a reliable opportunity with solid fundamentals and scope for moderate-to-high returns by 2025–26.

✅ 2026 Target View – CONCOR (Container Corporation of India):

If DFC rollouts face delays, EXIM trade slows, or regulatory bottlenecks impact terminal operations, CONCOR’s stock could dip toward ₹500.

However, if dedicated freight corridors ramp up, logistics reforms accelerate, and container volumes grow steadily, the stock could climb to ₹950 or even higher by FY2026.

📉 Downside Risk: ₹500 (approx. -13%)

📈 Upside Potential: ₹950 (approx. +64%)

🔎 Note:

These targets are indicative, not guaranteed. Projections consider CONCOR’s leadership in rail logistics, operational scale, government push for lower logistics costs, and improved network efficiency post-DFC rollout.

Investors should also assess trade growth trends, freight pricing dynamics, competition from private logistics players, and policy reforms before taking long-term positions.

📊 For Short-Term / Intraday Traders:

If you want daily trading levels, live analysis, and intraday strategies for Concor and other stocks — join our free Telegram group, where you get professional-level market insights and trading guidance every day.

📊 CONCOR Financial Overview (2021–2025)

| Year | Revenue (₹ Cr) | Growth (%) | Net Profit (₹ Cr) | Net Profit Margin (%) | EPS | EPS Growth (%) | ROE (%) | Shareholders' Funds (₹ Cr) | Total Debt (₹ Cr) | Debt to Equity |

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 6697.49 | — | 505.14 | 7.54 | 8.0 | — | — | 10191.63 | 2114.53 | 0.21 |

| 2022 | 7899.81 | 17.95 | 1055.12 | 13.36 | 17.0 | 112.50 | 10.07 | 10760.11 | 2140.23 | 0.20 |

| 2023 | 8482.52 | 7.38 | 1173.87 | 13.84 | 19.0 | 11.76 | 10.68 | 11230.61 | 2132.51 | 0.19 |

| 2024 | 9023.75 | 6.38 | 1260.59 | 13.97 | 21.0 | 10.53 | 10.92 | 11847.43 | 2087.30 | 0.18 |

| 2025 | 9333.93 | 3.44 | 1288.75 | 13.81 | 21.0 | 0.00 | 10.64 | 12380.19 | 1989.29 | 0.16 |

⚡ Container Corporation of India (CONCOR) 📊 Fundamental Analysis: Can This Logistics PSU Sustain Its Steady Growth?

Container Corporation of India Ltd (CONCOR), a Navratna PSU under Indian Railways, plays a crucial role in India’s EXIM trade and domestic container logistics. With robust infrastructure, improving profitability, and focus on multimodal logistics, let’s analyze CONCOR’s performance from FY2021 to FY2025.

🔸 Revenue & Growth (CAGR: 8.65%)

CONCOR’s revenue has shown steady growth driven by an increase in domestic and EXIM container volumes, pricing adjustments, and logistical expansion.

| Year | Revenue (₹ Cr) | Growth (%) |

|---|---|---|

| 2021 | 6,697.49 | — |

| 2022 | 7,899.81 | +17.95% |

| 2023 | 8,482.52 | +7.38% |

| 2024 | 9,023.75 | +6.38% |

| 2025 | 9,333.93 | +3.44% |

📈 CAGR: 8.65% — Reflects healthy, stable expansion amid infrastructure-led growth.

🔸 Net Profit & Margins

Profit margins have improved significantly post-pandemic, driven by operational efficiency and better volume realization.

| Year | Net Profit (₹ Cr) | Margin (%) |

|---|---|---|

| 2021 | 505.14 | 7.54% |

| 2022 | 1,055.12 | 13.36% |

| 2023 | 1,173.87 | 13.84% |

| 2024 | 1,260.59 | 13.97% |

| 2025 | 1,288.75 | 13.81% |

💡 Double-digit margins since FY22 underline efficient cost control and rising capacity utilization.

🔸 Earnings Per Share (EPS) Growth

EPS has nearly tripled in four years, mirroring net profit growth and efficient capital usage.

| Year | EPS (₹) | Growth (%) |

|---|---|---|

| 2021 | 8.0 | — |

| 2022 | 17.0 | +112.50% |

| 2023 | 19.0 | +11.76% |

| 2024 | 21.0 | +10.53% |

| 2025 | 21.0 | 0.00% |

📌 Stable EPS in FY25 suggests maturity; future expansion may reignite growth.

🔸 Return on Equity (ROE)

CONCOR maintains strong ROE, though slightly moderating due to higher equity base.

| Year | Net Profit (₹ Cr) | Avg. Equity (₹ Cr) | ROE (%) |

|---|---|---|---|

| 2021 | 505.14 | — | — |

| 2022 | 1,055.12 | 10,475.87 | 10.07 |

| 2023 | 1,173.87 | 10,995.36 | 10.68 |

| 2024 | 1,260.59 | 11,539.02 | 10.92 |

| 2025 | 1,288.75 | 12,113.81 | 10.64 |

📈 ROE above 10% consistently — indicating effective capital deployment.

🔸 Debt-to-Equity Ratio

CONCOR is nearly debt-free, a big positive in a capital-intensive industry.

| Year | Total Debt (₹ Cr) | Equity (₹ Cr) | D/E Ratio |

|---|---|---|---|

| 2021 | 2,114.53 | 10,191.63 | 0.21 |

| 2022 | 2,140.23 | 10,760.11 | 0.20 |

| 2023 | 2,132.51 | 11,230.61 | 0.19 |

| 2024 | 2,087.30 | 11,847.43 | 0.18 |

| 2025 | 1,989.29 | 12,380.19 | 0.16 |

✅ Gradual decline in Debt-to-Equity ratio confirms strong balance sheet health.

🔸 Liquidity Ratios

| Year | Current Ratio | Quick Ratio |

|---|---|---|

| 2021 | 2.22 | 2.17 |

| 2022 | 2.54 | 2.49 |

| 2023 | 2.77 | 2.72 |

| 2024 | 2.88 | 2.83 |

| 2025 | 3.01 | 2.97 |

💧 High liquidity with Current Ratio > 2.0 — excellent for short-term solvency.

🔸 Return on Capital Employed (ROCE)

| Year | ROCE (%) |

|---|---|

| 2021 | 7.45 |

| 2022 | 13.24 |

| 2023 | 14.23 |

| 2024 | 14.42 |

| 2025 | 14.46 |

📊 ROCE shows solid capital efficiency gains — well above cost of capital.

✅ Conclusion: A Strong PSU Logistics Play with Reliable Growth

✅ Strengths

🚄 Monopoly-like position in container rail transport

📦 Multimodal logistics leadership in India

💸 Debt-light, cash-rich balance sheet

📈 Double-digit ROE & improving ROCE

🔄 Long-term volume tailwinds from EXIM/dedicated freight corridors

⚠️ Risks

🛤️ Rail freight dependency — exposed to railway tariff policies

🏗️ Infrastructure delays or capacity constraints

📉 Growth moderating post FY23

🔄 Competition from private logistics players and road transport

📌 Verdict:

CONCOR is a stable, low-debt logistics PSU with strong financials and improving margins. While revenue growth may moderate, its focus on operational efficiency, digitalization, and integrated logistics makes it a reliable long-term bet — especially for conservative investors seeking steady compounding with low risk.

✅ Best suited for: Long-term, low-risk investors looking for exposure to India’s logistics and infrastructure growth story.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

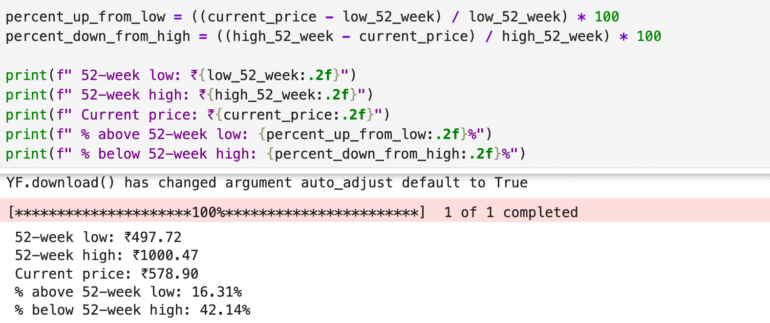

📈 Container Corporation of India 52-Week Price Performance Snapshot

52-Week Low: ₹497.72

52-Week High: ₹1,000.47

Current Market Price: ₹578.90

CONCOR is currently trading 16.31% above its 52-week low, reflecting a mild bounce from its support zone. However, the stock remains 42.14% below its 52-week high, indicating a significant decline and ongoing pressure.

📊 Interpretation:

The stock appears to be consolidating after a major correction from its highs. The sharp drawdown could be attributed to:

Weak volume recovery in freight/logistics

Competitive pressures in the logistics and container space

Higher capital expenditures or subdued margin performance

Still, CONCOR’s strong fundamentals, healthy balance sheet, and government backing offer a cushion against major downside risks.

As trade volumes recover and infrastructure investments pick up, long-term potential remains intact. However, investors should watch for breakout signals above ₹600 to confirm upward momentum.

🔎 For value-oriented investors:

CONCOR may offer a good accumulation zone for those with a medium to long-term horizon, especially if supported by volume and improving financial metric

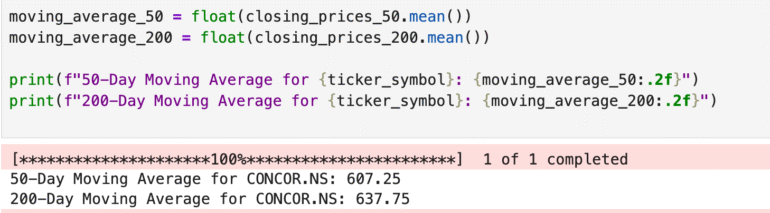

📊 CONCOR – Moving Averages Analysis

50-Day Moving Average (DMA): ₹607.25

200-Day Moving Average (DMA): ₹637.75

Current Market Price (CMP): ₹578.90

📈 Technical Insight:

CONCOR’s stock is currently trading below both its 50-day and 200-day moving averages, which is typically a bearish signal from a technical standpoint.

➡️ Falling below the 50-DMA indicates weakening short-term buying interest.

➡️ Trading below the 200-DMA suggests the long-term trend has also softened, possibly due to sector uncertainty or lower market sentiment.

➡️ A breakout above these moving averages could signal a shift in momentum and potential bullish reversal.

📌 Conclusion:

CONCOR appears to be in a technical correction or consolidation phase.

Until the stock reclaims key moving averages, short-term traders may stay cautious.

However, long-term investors can continue to monitor the stock given its stable financials and potential for growth in the logistics and infrastructure space.

🔍 Competitor Analysis: How CONCOR Stacks Up

While Container Corporation of India (CONCOR) leads in intermodal logistics and rail-based freight, it’s important to benchmark it against other major players in India’s logistics and shipping sector:

InterGlobe Aviation (IndiGo) – India’s top airline with growing focus on air cargo logistics.

Container Corporation of India (CONCOR) – Leader in rail-based container logistics.

Delhivery – Tech-driven e-commerce logistics company with strong last-mile reach.

Blue Dart Express – Premium courier and express delivery firm backed by DHL.

GE Shipping Co. – India’s largest private shipping company, strong in sea freight.