In today’s world, investors have numerous opportunities, but knowing how to choose stocks effectively remains a significant challenge. Many investors struggle to determine where to begin or which data is most useful for their decision-making.

Have you ever wondered how to navigate market fluctuations and make the right stock choices? Or how a lack of expertise in stock selection strategies could impact your returns?

We have the solution for you. To simplify your investment journey, we offer data-driven stock analysis and expert guidance. Whether you’re a beginner learning how to choose stocks or an experienced investor refining your strategy, our insights will help you make profitable decisions.

Let’s dive into proven methods smart investors use to select the right stocks and maximize their returns.

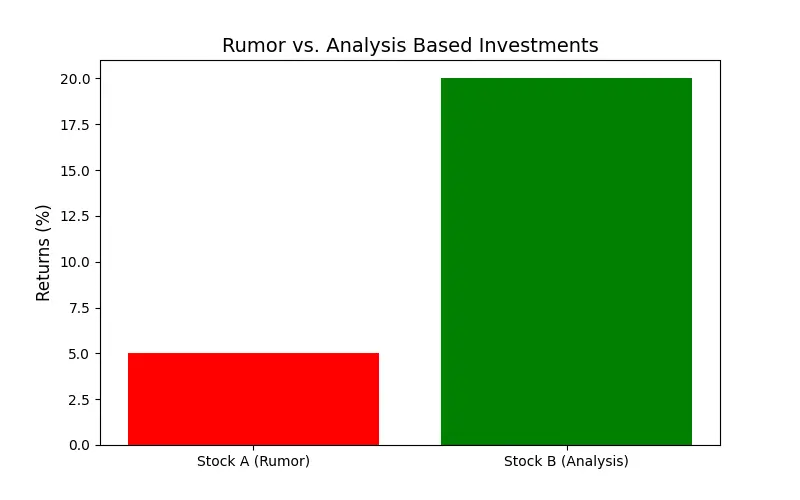

Mistake:

Many investors buy stocks based on rumors or advice from friends, which often leads to poor results.

Solution:

Data and analysis provide confidence and stability in investments. Using both fundamental analysis and technical analysis helps make more informed decisions.

Example:

Investors who rely on analysis rather than speculation achieve significantly higher returns.

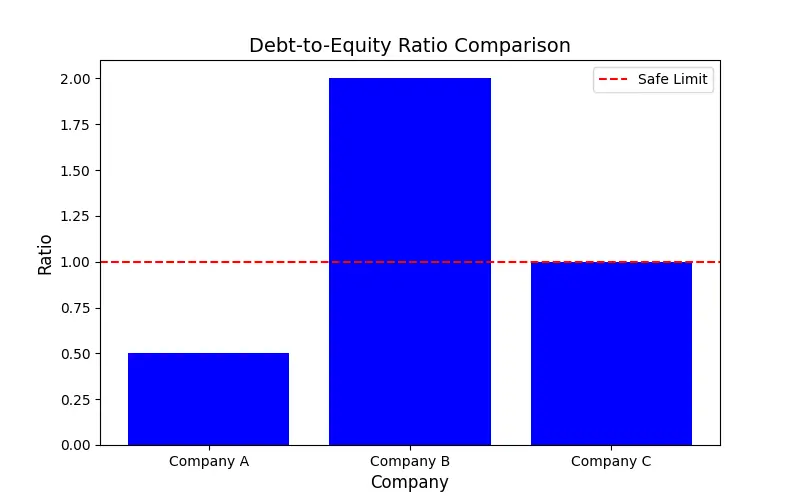

Fundamental analysis helps understand a company’s financial health and long-term potential.

The Debt-to-Equity Ratio helps measure a company’s financial stability. The chart below illustrates the Debt-to-Equity Ratios of three companies. The red dotted line indicates the safe threshold, which should ideally not be exceeded.

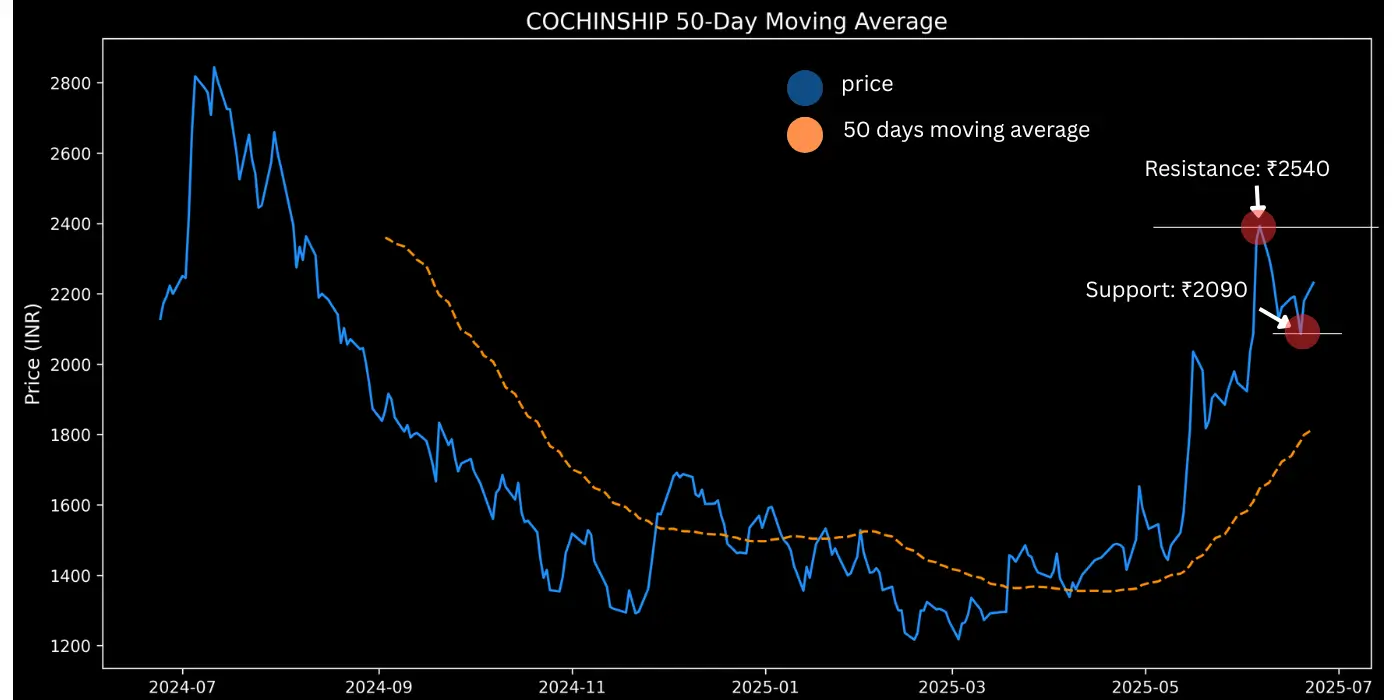

Technical analysis identifies stock price trends and market patterns.

Moving Averages, such as the 50-day and 200-day averages, help identify stock price trends. The chart below illustrates how a stock’s price movement relates to its moving averages.

Neelam, a 30-year-old investor, decided to invest in the IT sector. She analyzed Infosys’ financials, noting low debt and strong profits. She also reviewed its 50-day and 200-day moving averages, which showed a positive trend.

Result:

Neelam bought Infosys stocks at ₹1,200, which rose to ₹1,900 in two years.

Choosing the right stocks is both an art and a science. With data-driven analysis, you can eliminate emotional decisions and focus on sustainable growth. Explore opportunities in Indian stock markets and build a long-term strategy for success.

“Smart investing is about combining intelligence, patience, and strategy to achieve your financial goals.”